Commercial real estate activity is changing. Buyers are focusing on properties that feel safer and are easier to use long term. Industrial properties, logistics sites, and reused buildings are leading deal activity. Investors are choosing steady performance instead of taking big risks. These commercial real estate trends show a clear shift in how deals are moving forward.

Industrial assets continue to attract buyers

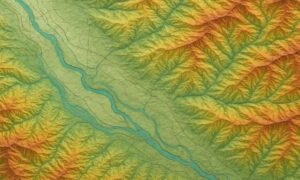

Industrial properties tied to shipping, storage, and local transportation remain the most active type of property. Buyers prefer sites that support daily operations and steady tenant use. Being close to highways, ports, and rail lines has become a major factor in property value.

Sale-leaseback deals are also happening more often. These deals allow owners to get cash while staying in their buildings. Because of this, buyers now look earlier at access points, property lines, and how the site is set up.

Office buildings are being reused more often

Older office buildings are being turned into medical spaces, housing, or mixed-use properties. These changes raise questions about zoning, access, and lot layout. These issues need to be reviewed earlier in the deal.

Buyers are no longer waiting until the end of a transaction to find problems. Property lines, access rights, and legal records are now checked early and often affect pricing.

Commercial land deals face tighter rules

Land sales move forward when pricing matches current conditions and development plans are clear. Properties with access problems or unclear boundaries take longer to sell. Many also receive lower offers.

Market takeaway

In Mobile, commercial deals favor clarity. Properties with clear boundaries, defined access, and fewer unknowns move faster and attract more buyers.